The Ultimate Rise48 Equity 1031 Exchange Guide

When it comes to real estate investments, a powerful tool available to investors is the 1031 Exchange. Named after Section 1031 of the Internal Revenue Code, this tax-deferral strategy allows investors to sell a property and reinvest the proceeds into a new, like-kind property while deferring capital gains taxes. For those interested in multifamily investing and working with firms like Rise48 Equity, understanding and leveraging the 1031 Exchange rules can be a game-changer in building long-term wealth.

The 1031 Exchange is a legally sanctioned method to help real estate investors grow their portfolios without the immediate burden of capital gains taxes. Here are the foundational rules and requirements to qualify for a 1031 Exchange with Rise48 Equity:

Foundational Rules and Requirements to Qualify for a 1031 Exchange with Rise48 Equity

- Determine Eligibility:

- Criteria: Ensure the property is an investment or business property (not personal residence).

- Same Nature: Both the sold property (relinquished) and the purchased property (replacement) must be “like-kind” (similar in nature or character).

- Sell the Relinquished Property:

- Buyer Agreement: Find a buyer to sell the relinquished property.

- Qualified Intermediary (QI): Engage a QI before close of escrow. The QI will hold the sale proceeds while you identify a replacement property.

- Identify Replacement Property:

- 45-Day Rule: Identify potential replacement property/properties within 45 days of selling the relinquished property.

- Reach out to Rise48 Equity: Reach out to Rise48 to see if we have a spot open in case you would like to roll your proceeds into a property that Rise48 has under contract to acquire.

- Commit 1031 Exchange Funds:

- Express Interest to the Rise48 Team: Reach out to our team for next steps.

- Discuss the 1031 Exchange Mechanics: We will schedule dedicated time with you to discuss the various mechanics of the 1031 exchange process, the current multifamily opportunity we plan to acquire, and the organizational deal structure to preserve your 1031 exchange.

- Commit to the 1031 Exchange with Rise48:

Our dedicated Transactions team will work with you and your QI throughout the entirety of the transaction, making sure your 1031 exchange is executed accordingly.

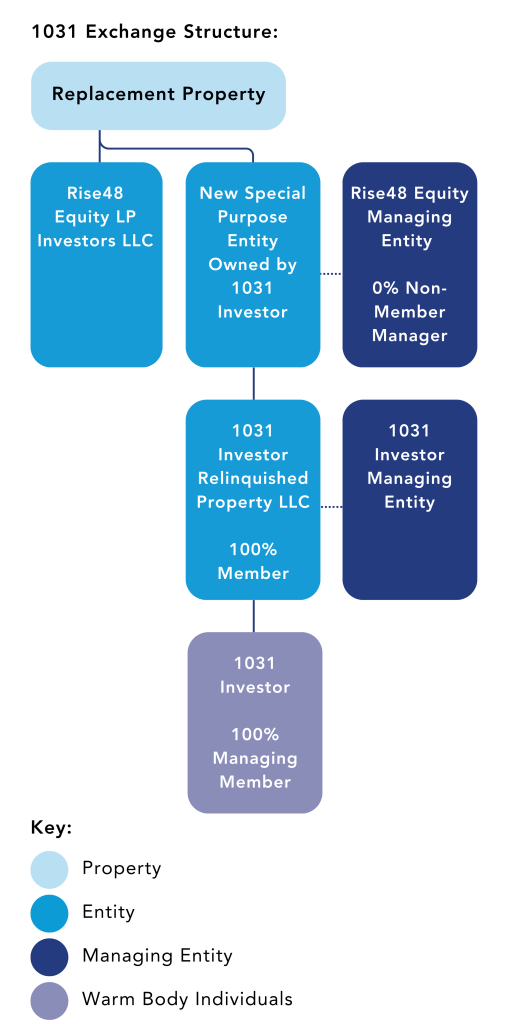

5. 1031 Exchange Structure:

- Download our 1031 exchange guide here.

The Benefits of 1031 Exchange Funds

A 1031 exchange, also known as a like-kind exchange, offers significant benefits for real estate investors looking to grow their portfolio while deferring capital gains taxes. By reinvesting proceeds from the sale of an investment property into another qualifying property, investors can defer paying taxes on the profits from the sale, allowing them to leverage more capital for their next investment. This tax deferral can lead to substantial savings, enabling investors to potentially increase their purchasing power and compound their real estate investments over time. Additionally, a 1031 exchange provides flexibility in managing and diversifying real estate portfolios, as investors can exchange properties across different markets or asset types. This strategy not only enhances financial growth but also offers opportunities for strategic long-term wealth building.

1. Diversification of Real Estate Portfolio

One of the most strategic uses of 1031 Exchange funds is to diversify a real estate portfolio. For instance, an investor might sell a single high-value property and reinvest in multiple properties across different markets. This approach spreads risk and increases the potential for returns. With Rise48 Equity, investors can tap into a range of real estate opportunities, leveraging their 1031 Exchange funds to acquire assets in various high-growth markets.

2. Switching Property Types

Another strategy is to change the type of property within the like-kind classification. For instance, an investor might exchange a retail property for a multifamily investment property. This flexibility allows investors to adapt to market conditions and trends, optimizing their portfolios for better performance.

The Role of Rise48 Equity in 1031 Exchange Investments

Navigating the complexities of 1031 Exchanges can be challenging, but partnering with a dedicated investment firm like Rise48 Equity can simplify the process and maximize the benefits. Here’s how Rise48 Equity can assist investors in executing successful 1031 Exchanges:

1. Expert Guidance and Strategy

Rise48 Equity will strategize with the specific needs of each investor. From managing the transaction timelines, Rise48 ensures that the 1031 Exchange process is smooth and compliant with SEC regulations.

2. Access to Premium Investment Opportunities

With a focus on high-growth markets (Phoenix, AZ, Dallas, TX, and Charlotte, North Carolina) and value-add opportunities, Rise48 helps give investors the opportunity to leverage a 1031 into our properties.

3. Comprehensive Support from Start to Finish

Rise48 Equity provides comprehensive support throughout the entirety of the transaction, making sure your 1031 Exchange is executed accordingly. Our Transactions team of experts will discuss the details and various mechanics of the 1031 Exchange process, the current multifamily opportunity we plan to acquire, and the organizational deal structure to preserve your 1031 Exchange. This process allows investors to focus on their broader investment goals.

Is a 1031 Exchange Right for You?

Deciding whether to use a 1031 Exchange depends on your individual investment strategy and financial goals. If you’re looking to defer capital gains taxes and continue growing your real estate portfolio, a 1031 Exchange might be the ideal solution. Reach out to Rise48 Equity to connect with our team to see what opportunities we have available for your next 1031 exchange.

Conclusion: Committing to the 1031 Exchange with Rise48

The 1031 Exchange is a valuable tool for real estate investors seeking to maximize their returns and defer capital gains taxes. By understanding the rules and strategically using 1031 Exchange funds, investors can enhance their portfolios and achieve long-term financial freedom. Rise48 Equity stands ready to assist in every step of the process, providing expert advice, premium investment opportunities, and comprehensive support to ensure your 1031 Exchange is executed correctly.

ABOUT RISE48 EQUITY:

Rise48 Equity is a Multifamily Investment Group with local offices in Phoenix, AZ, Dallas, TX, and Charlotte, NC. “At Rise48 Equity, we provide opportunities for accredited and non-accredited investors to protect and grow their wealth and achieve passive cash-flow. Our team brings expertise to acquire, reposition and return capital to investors upon reaching our business plan. Through our research and strategically formed partnerships, we acquire commercial multifamily apartment properties, strategically add value to the properties, and create passive income for our investors through cash-flow and profits from sale.”

Since 2019, Rise48 Equity has completed over $2.22 Billion+ in total transactions, and currently has $1.8 Billion+ assets under management located in Phoenix, Dallas, and Charlotte. All of the company’s assets under management are managed by Rise48 Equity’s vertically integrated property management company, Rise48 Communities.

If you’re considering a 1031 Exchange, contact Rise48 Equity today to learn how we can help you optimize your real estate investments and secure your financial future.

Download our 1031 exchange guide to get an overview on how you can start your 1031 exchange journey!