RISE MELROSE

- 96 Units in Phoenix, AZ

- Acquisition Date: May 2021

- Disposition Date: July 2022

- 14 Month Hold Period

- $18,400,000 Purchase Price

- $25,500,000 Sale Price

- 2.02x Equity Multiple Project Level

- 84.8% IRR Project Level

- Rise48 Equity’s 11th Disposition since 2019

SCOTTSDALE 5TH AVE

- 59 Units in Phoenix, AZ

- Acquisition Date: August 2019

- Disposition Date: June 2022

- 34 Month Hold Period

- $6,600,000 Purchase Price

- $14,115,000 Sale Price

- 3.42x Equity Multiple Project Level

- 54.5% IRR Project Level

- Rise48 Equity’s 10th Disposition since 2019

- 59 Units in Phoenix, AZ

- Acquisition Date: August 2019

- Disposition Date: June 2022

- 34 Month Hold Period

- $6,600,000 Purchase Price

- $14,115,000 Sale Price

- 3.42x Equity Multiple Project Level

- 54.5% IRR Project Level

- Rise48 Equity’s 10th Disposition since 2019

RISE ON THOMAS

- 100 Units in Phoenix, AZ

- Acquisition Date: April 2021

- Disposition Date: June 2022

- 14 Month Hold Period

- $14,200,000 Purchase Price

- $21,000,000 Sale Price

- 1.86x Equity Multiple Project Level

- 66.3% IRR Project Level

- Rise48 Equity’s 9th Disposition since 2019

RISE DOWNTOWN MESA

• 103 Units in Phoenix, AZ

• Acquisition Date: March 2021

• Disposition Date: May 2022

• 14 Month Hold Period

• $16,500,000 Purchase Price

• $26,250,000 Sale Price

• 2.26x Equity Multiple Project Level

• 115.2% IRR Project Level

• Rise48 Equity’s 8th Disposition since 2019

• 103 Units in Phoenix, AZ

• Acquisition Date: March 2021

• Disposition Date: May 2022

• 14 Month Hold Period

• $16,500,000 Purchase Price

• $26,250,000 Sale Price

• 2.26x Equity Multiple Project Level

• 115.2% IRR Project Level

• Rise48 Equity’s 8th Disposition since 2019

RISE ON PEORIA

• 164 Units in Phoenix, AZ

• Acquisition Date: April 2021

• Disposition Date: May 2022

• 13 Month Hold Period

• $28,700,000 Purchase Price

• $45,400,000 Sale Price

• 2.45x Equity Multiple Project Level

• 132.2% IRR Project Level

• Rise48 Equity’s 7th Disposition since 2019

RISE METRO

• 160 Units in Phoenix, AZ

• Acquisition Date: January 2021

• Disposition Date: April 2022

• 14 Month Hold Period

• $24,300,000 Purchase Price

• $42,000,000 Sale Price

• 2.45x Equity Multiple Project Level

• 108.6% IRR Project Level

• Rise48 Equity’s 6th Disposition since 2019

• 160 Units in Phoenix, AZ

• Acquisition Date: January 2021

• Disposition Date: April 2022

• 14 Month Hold Period

• $24,300,000 Purchase Price

• $42,000,000 Sale Price

• 2.45x Equity Multiple Project Level

• 108.6% IRR Project Level

• Rise48 Equity’s 6th Disposition since 2019

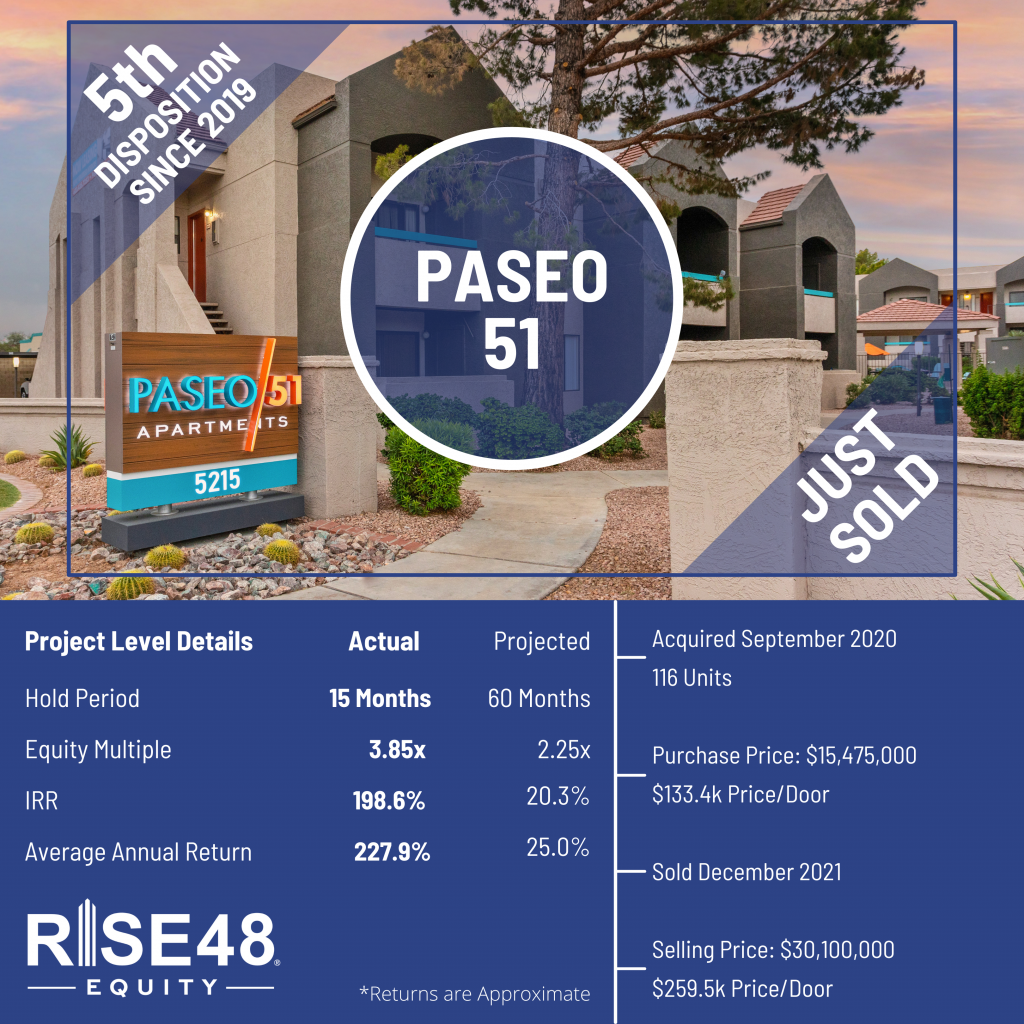

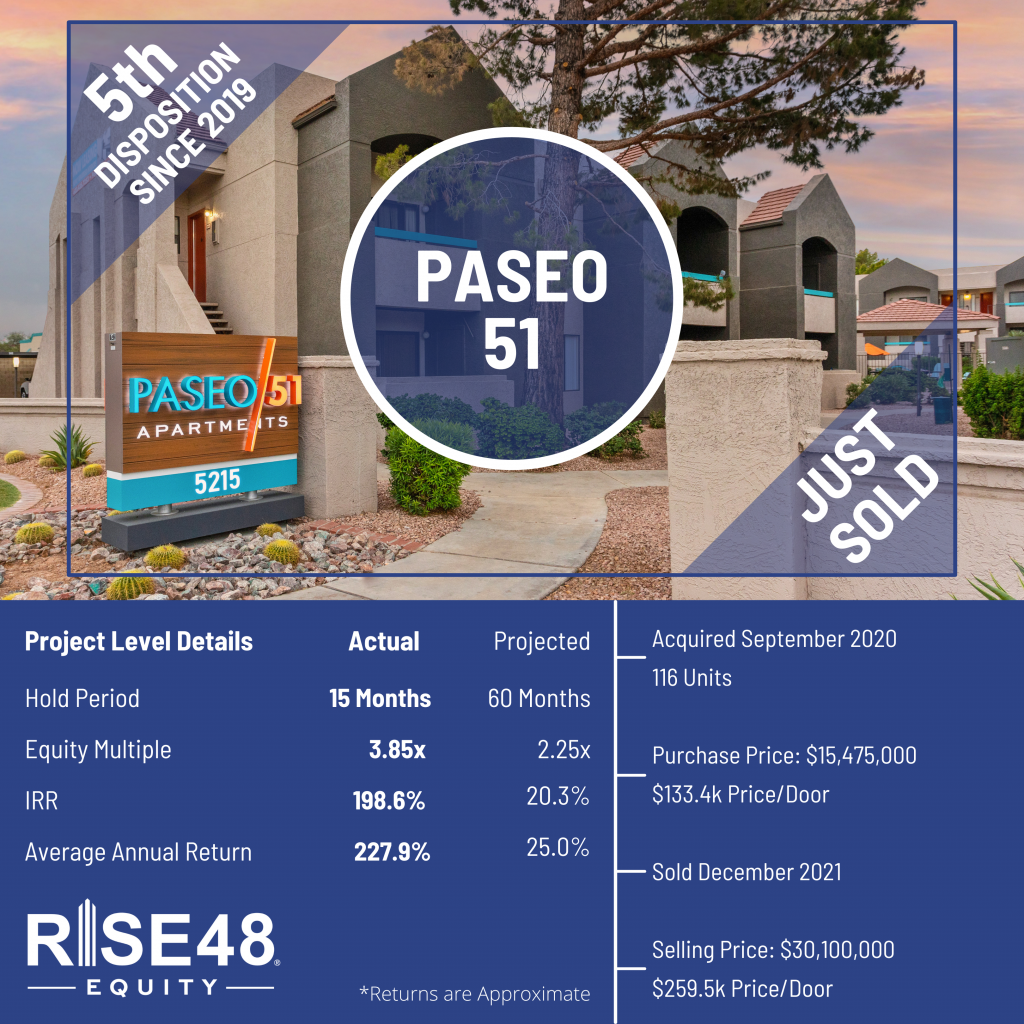

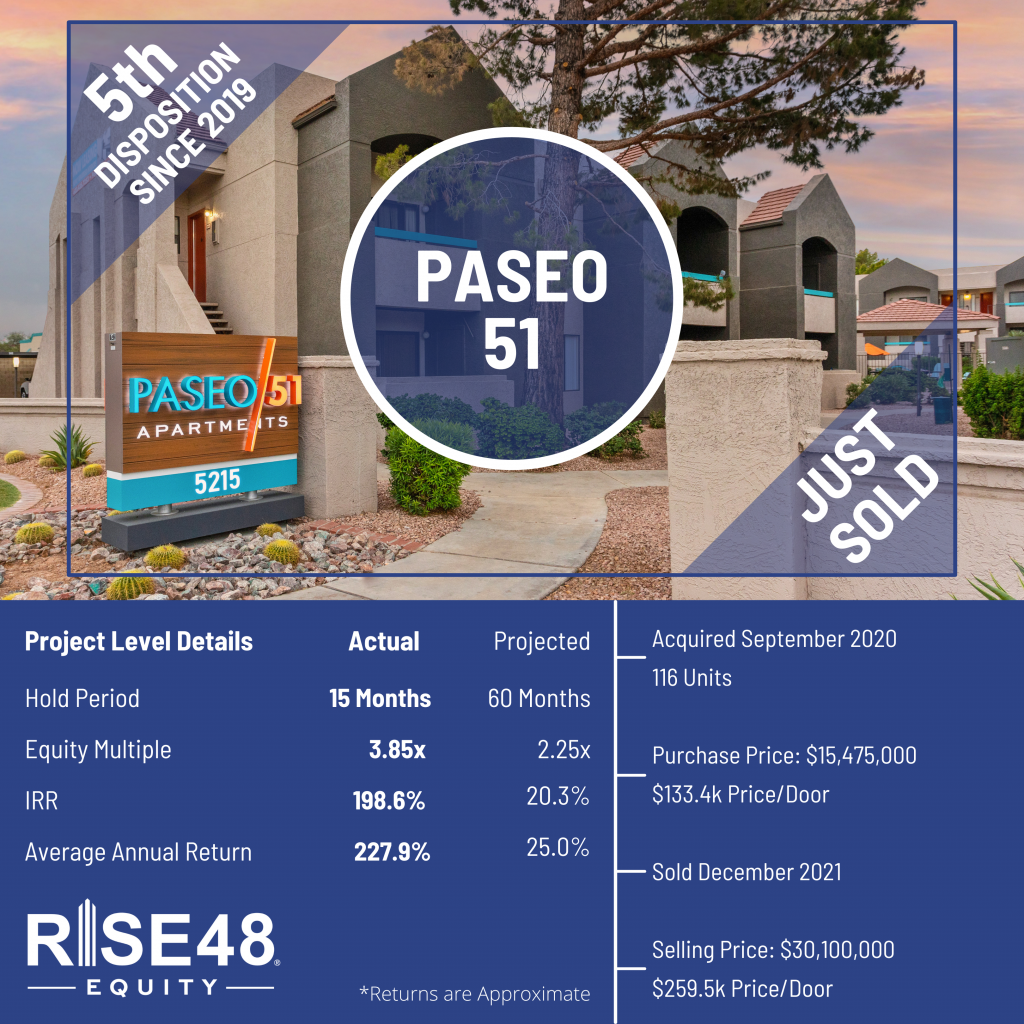

PASEO 51

• 116 Units in Glendale, AZ

• Acquisition Date: September 2020

• Disposition Date: December 2021

• 15 Month Hold Period

• $15,475,000 Purchase Price

• $30,100,000 Sale Price

• 3.85x Equity Multiple Project Level

• 198.6% IRR Project Level

• Rise48 Equity’s 5th Disposition since 2019

VILLA SERENA

• 137 Units in Phoenix, AZ

• Acquisition Date: August 2019

• Disposition Date: November 2021

• 27 Month Hold Period

• $17,575,000 Purchase Price

• $32,000,000 Sale Price

• 3.00X Equity Multiple Project Level

• 65.4% IRR Project Level

• Rise48 Equity’s 4th Disposition since 2019

• 137 Units in Phoenix, AZ

• Acquisition Date: August 2019

• Disposition Date: November 2021

• 27 Month Hold Period

• $17,575,000 Purchase Price

• $32,000,000 Sale Price

• 3.00X Equity Multiple Project Level

• 65.4% IRR Project Level

• Rise48 Equity’s 4th Disposition since 2019

RISE ON MCDOWELL

• 76 Units in Phoenix, AZ

• Acquisition Date: August 2019

• Disposition Date: November 2021

• 26 Month Hold Period

• $6,900,000 Purchase Price

• $15,550,000 Sale Price

• 2.90X Equity Multiple Project Level

• 62% IRR Project Level

• Rise48 Equity’s 3rd Disposition since 2019

DISTRICT FLATS OFF DOBSON

• 112 Units in Phoenix, AZ

• Acquisition Date: March 2020

• Disposition Date: May 2021

• 13.5 Month Hold Period

• $13,000,000 Purchase Price

• $18,200,000 Sale Price

• 1.95X Equity Multiple Project Level

• 83.7% IRR Project Level

• Rise48 Equity’s 2nd Disposition since 2019

• 112 Units in Phoenix, AZ

• Acquisition Date: March 2020

• Disposition Date: May 2021

• 13.5 Month Hold Period

• $13,000,000 Purchase Price

• $18,200,000 Sale Price

• 1.95X Equity Multiple Project Level

• 83.7% IRR Project Level

• Rise48 Equity’s 2rd Disposition since 2019

SILVER OAKS

• 36 Units in Phoenix, AZ

• Acquisition Date: February 2019

• Disposition Date: October 2020

• 21 Month Hold Period

• $3,450,000 Purchase Price

• $5,350,000 Sale Price

• 1.91X Equity Multiple Project Level

• 44.6% IRR Project Level

• Rise48 Equity’s 1st Disposition