UPDATES ON RISE48 EQUITY

Operations Update

Q4 2021 was a great month for the Company. Overall, we acquired seven new assets and sold one asset. At the end of the quarter, we had 17 assets under management and sold five assets. We also had some great luck with getting some new deals under contract. We also decided to list five more assets for sale in Q1 2022 to capture the profits for our investors and exchange the funds into larger, more stabilized assets.

In December 2021, we also vertically integrated with our Property Management Company, Rise48 Communities. Going through an operational transition is no joke. It’s pretty much as if we acquired all of the assets all over again. Although the transition was painful, we’re headed in the right direction with operations. Results dipped in November and December largely due to the transition but Q1 2022 is starting off right with better onsite staff and better corporate support to ensure that the assets perform to their highest abilities.

CapEx Update

Our average rental premium for renovated units was just above $220 per unit (monthly increase). The current market cap rate for a fully stabilized asset is around 3.5% to 4.0% At a 4.0% cap rate, this means that we’re adding more than $66,250 in value for every unit that we renovate at each property.

PHOENIX MSA UPDATE

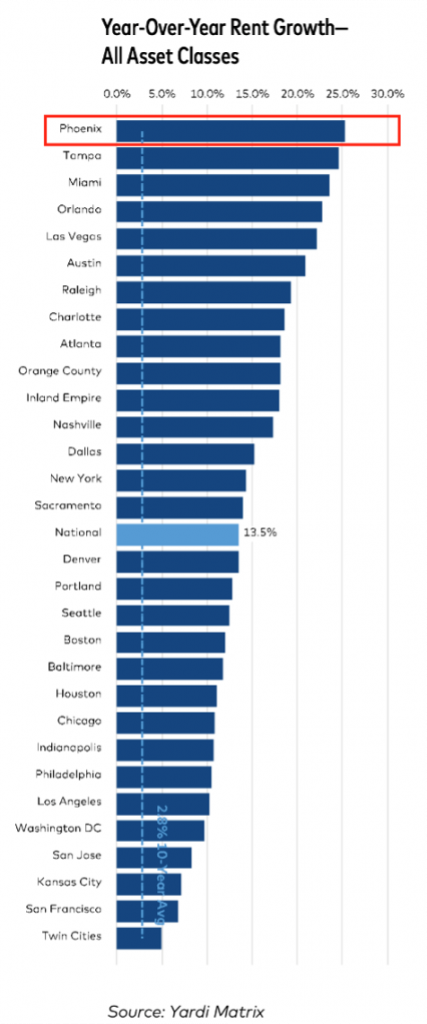

Realpage reported a year over year increase of more than 26.30% in rental growth in the market as of December 2021. Yardi reported a similar increase of about of 25.3% year over year rental increase. Yardi anticipates Phoenix to have approximately 25.8% rental growth for the next 12 months. Per Costar, the current market inventory in the Phoenix MSA is approximately 455 thousand units with more than 31 thousand units under construction.

Northmarq released “Trends to Watch in 2022” report. Rent growth is expected to stabilize and not repeat 2021. Arizona is expected to add more than 500,000 new jobs in 2022, just behind California and ahead of Texas and Florida.

Marcus and Millichap also released their investment forecast for 2022. The firm ranked Phoenix as the fifth best market in the nation based (just behind Florida markets) on forward looking economic indicators. The firm noted, “Strong rent growth, low availability and robust household creation combine to give Phoenix a high ranking this year.”

The firm expects rents to increase by just 7.2% during the year, well below C ostar, Yardi, and Realpage and expects employment to grow by 3.9% for the year.

ABI also released their YE 2021 Phoenix MSA Snap Stats. Throughout the market average rent/unit increased $230 year over year and occupancy increased by 0.8% year over year. Unemployment rate also decreased to 2.8% while employment grew by 5.6%

Phoenix also ranked #1 in the nation for home price growth. According to the S&P CoreLogic Case-Shiller report, Phoenix home prices grew 32.3% year over year while national home prices grew about 19.1% as of October 2021.

Rise48 Equity has completed $817,116,000 in total transactions since 2019, and currently has $659,516,000 of Assets Under Management, all in the Phoenix MSA.

To learn more about our investments, schedule a call: www.rise48equity.com/invest